“Cost Plus” is one of the most basic pricing methods for goods and services. Under this method, the manufacturer or service provider calculates the Total Direct Cost of an item by adding the direct material, direct labor and direct overhead costs required to produce it. To this, it adds the Sales, General & Administrative (SG&A) overhead costs to arrive at the Total Cost. By loading a markup / margin to this Total Cost figure, the company arrives at the Selling Price.

Many people I know tend to have an opinion – right or wrong – of what it should cost a company to produce an item. Let me call this “Perceived Cost”. For example, if they’re about to buy a writing pad, they’d quickly break the product up into paper, cover page, stapling and binding, and assign a cost to each of these “sub-items”. By adding up these costs, they’d arrive at the Perceived Cost. They’d then add a markup, which could range from 5% to 25% depending upon their views on “profit motive”, and arrive at what they’d consider a fair price. If the actual selling price is close to this ‘fair price’, they’d conclude that the item is priced “reasonably”. If the actual selling price is way above (or way below) this figure, they’d complain about profiteering (or cast aspersions on the genuineness of the item) and likely put their purchase decision on hold.

Based on this sort of empirically observed consumer behavior, I am proposing a new pricing method in which a company arrives at the selling price by adding a certain markup to the ‘perceived cost’ (rather than ‘actual cost’ as is the case in the traditional “Cost Plus” method). Let me call this the “Perceived Cost Plus” pricing method.

When consumers have no perception of the cost or when the cost perceived by them equals the actual cost, Perceived Cost Plus pricing will be the same as traditional Cost Plus pricing.

Perceived Cost Plus gets interesting only when perceived cost does not equal actual cost. This happens in the following situations:

- Whenever a middleman is involved. Most buyers tend to believe that the additional layer introduced by the involvement of a middleman adds to the total cost.

- Buyers, especially in the lower economic strata or in developing economies, tend to think that things sold in an organized retail environment – such as a plush, air conditioned supermarket, with superior ambience – would cost more.

- Whenever goods have to be transported, especially across a country’s borders, buyers tend to ascribe a higher perceived cost.

However, buyers’ perceptions of higher costs are not always right.

- Wal-Mart is the world’s largest middleman, buying from the manufacturer and selling to the consumer. Its stores offer better ambience compared to a typical mom-and-pop store (aka ‘kirana’ shops in India). Still, prices in Wal-Mart are lower than almost anywhere else.

- Despite doomsday predictions made about the future of middlemen (distributors, dealers and retailers) at the height of the dot-com era of the late nineties, the fact is that most successful dot coms of today are not original manufacturers or service providers but middlemen like Amazon, Expedia, Travelocity, and so on. All of them have demonstrated a consistent track record of delivering lower prices.

In both these cases, actual costs are likely lower than the perceived costs.

How come?

Middlemen tend to have lower costs due to trade promotion policies and economies of scales (“bulk purchase”).

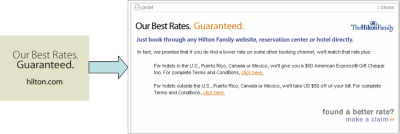

The pricing power wielded by middlemen is very well illustrated in the hotel industry where leading chains have been making announcements that they offer the lowest tariffs for rooms booked directly on their own (i.e. the hotel chain’s) websites rather than on the websites of middlemen. Some go a step further: for example, Hilton guarantees that if you do find a lower rate on some other booking channel, they’ll match that rate PLUS offer a $50 gift cheque for your trouble!

Click here to view Hilton’s guarantee.

Supermarkets that have opened up in India in the last one year provide another excellent example of offering lower prices than ‘kirana’ stores. Despite being plush and air conditioned, these supermarkets were the first to actually sell products at ‘below MRP’. (As per government regulation, all packaged goods in India must display a so-called Maximum Retail Price or MRP, which is the highest price at which the item can be sold by anyone nationwide.) Until recently, the common man didn’t expect lower-than-MRP prices. The recent mushrooming of supermarkets have changed that paradigm.

The above examples clearly show that actual costs and selling prices are not necessarily higher when middlemen are involved.

Let’s now take another example. It illustrates the same thing but also sounds a warning bell to marketers to take the concept of perceived cost seriously while formulating pricing policies or risk losing customers.

An emerging financial institution (FI) once ordered a PC from the original manufacturer, a large and reputed IT company. The FI never received the PC within the promised delivery period of four weeks. It got tired of hearing empty promises of getting the product in the “next two weeks” for the next six weeks. It decided to cancel the order and buy another PC from the market. When its leaders looked around, they saw the same model of the same company’s PC off-the-shelf at one of the dealers of the same IT company – and at a lower price! In other words, the middleman was able to supply the same item readily and at a lower price than the original manufacturer. You can imagine the FI’s shock when this happened!

What appears to be puzzling to a customer or the common man has a perfectly valid explanation to people who are clued in to pricing and dealer management policies like ‘First Dollar Rebate’, ‘Target Achievement Bonus’ and ‘Over Target Achievement Bonus’. FDR is the margin received by the Dealer on each unit starting from the first unit sold during the quarter (or whatever the quota period). If the Dealer achieves the quota, he gets a TAB. If the Dealer exceeds the quota by a certain percentage, he earns an OTAB. In the computer hardware industry, FDR is typically 20%, TAB is 5% and OTAB is 2%. The important point to note is that TAB and OTAB are applicable on all sales during the quarter – not just on sales exceeding the quota. Therefore, when this Dealer sold the PC to this FI at a lower price, he may have taken a beating on this one unit but he was earning TAB and OTAB on all the PCs he sold during the entire quarter. As a result, the Dealer made money on the overall quarter despite giving a higher discount to this FI than what the IT company’s own sales reps would have been permitted to extend to a new customer.

However, the FI didn’t know all this. Like most people, it felt that prices should be higher when a middleman aka Dealer is involved. When, on the contrary, it got a higher price from the original manufacturer, it felt that it was being taken for a ride. Its leaders got very p****d off with the company and blacklisted it in all their future hardware purchases. The IT company could have avoided that fate had its marketing org adequately heeded customer perceptions regarding costs while formulating its pricing and dealer management policies.

In a follow-on blog post, I will discuss the application of “Perceived Cost Plus” pricing method for a few specific products and services. Stay tuned!

Pingback: Pierres Service » Blog Archive » “perceived cost plus” as a new pricing mechanism

gillette fusion cartridges coupon…

?Perceived Cost Plus? as a New Pricing Mechanism « Talk of Many Things…